Company insolvencies are showing no signs of slowing down. The latest figures from the Insolvency Service show that 2,000 firms in England and Wales entered formal insolvency in September. That’s 2% higher than the same time last year, though slightly (2%) lower than in August. It’s another sign that while numbers aren’t climbing fast, the pressure on businesses is far from easing.

What the numbers show

Most companies, around 79%, went through Creditors’ Voluntary Liquidation (CVL), with 1,578 cases recorded in September. That’s roughly in line with both August 2025 and last year’s figures. It shows many directors are still taking control and closing their companies responsibly, giving themselves the chance to manage the process properly and protect creditors where they can.

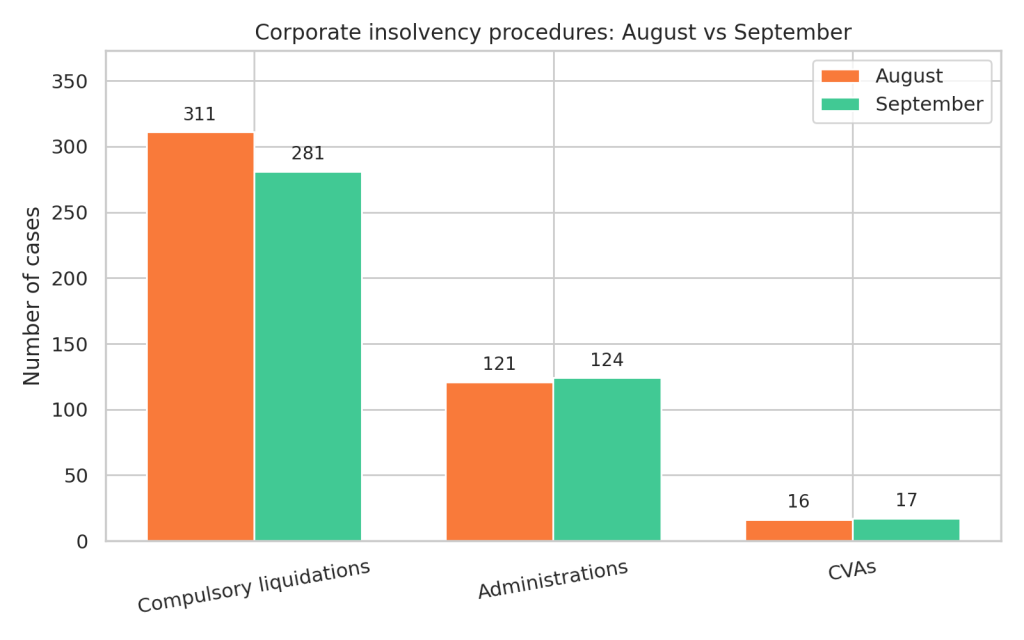

Compulsory liquidations hit 281 cases, which is 9% lower than August but 17% higher than September 2024. This rise year-on-year suggests that creditors, including lenders, suppliers, and HMRC, are becoming less patient when payments fall behind. It’s another reminder of how important timing is, the sooner a struggling business seeks help, the more choices they’ll have.

There were 124 administrations in September, 2% more than in August, but 17% fewer than last year. While they only make up just over 6% of total insolvencies, administrations can offer a real lifeline for businesses that are still viable but need breathing space to sort out cash flow or debt issues.

Company Voluntary Arrangements (CVAs) remain rare, with 17 cases reported, the same as last year and 6% up on August. Numbers are still low overall, showing that formal restructuring remains an underused option.

Across the past 12 months, the company liquidation rate was 52.9 per 10,000 active companies, or roughly 1 in 189 businesses. That’s a small improvement from last year’s 55 per 10,000, so while the number of insolvencies remains high, the overall rate has eased slightly.

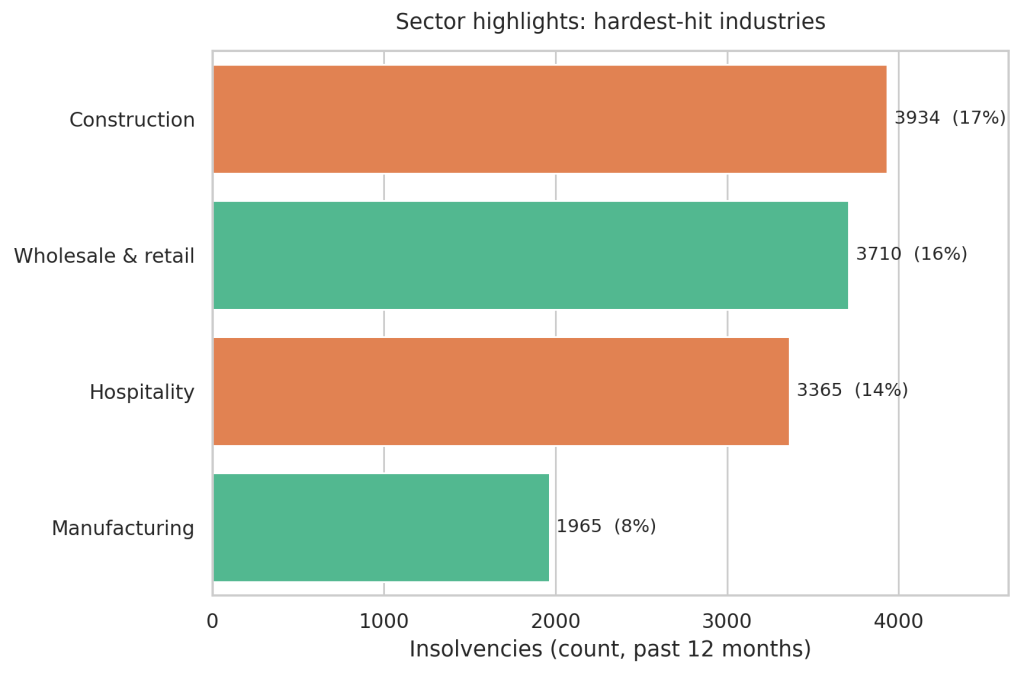

Sector highlights

The hardest-hit industries remain construction (3,934, 17%), wholesale and retail (3,710, 16%), and hospitality (3,365, 14%). Manufacturing has also seen its share of difficulties, with 1,965 insolvencies (8%) over the past year.

Our view

Richard Hunt, insolvency practitioners at Exigen Group, says:

“These numbers show a steady but still challenging landscape for UK businesses. Most directors are taking responsible action through CVLs before things get out of hand, which is positive. But the rise in compulsory liquidations shows some creditors are losing patience. Administrations are still underused, yet when they’re the right fit, they can save viable businesses and jobs. Acting early and choosing the right route really matters.”

While insolvency levels have held steady, the pressures keeping them there haven’t gone away. High interest rates, slow payments, and rising costs continue to squeeze margins. Most companies entering insolvency are still opting for CVLs, but for some, there may still be a path to rescue if they act soon enough.

For directors and advisors, now’s the time to stay alert, keep an eye on cash flow, maintain communication with creditors, and stay aware of what’s happening in your sector. Small, early steps can make all the difference between recovery and closure.